Stock Market Crash. What happened?

Stock Market Crash – What Happened?

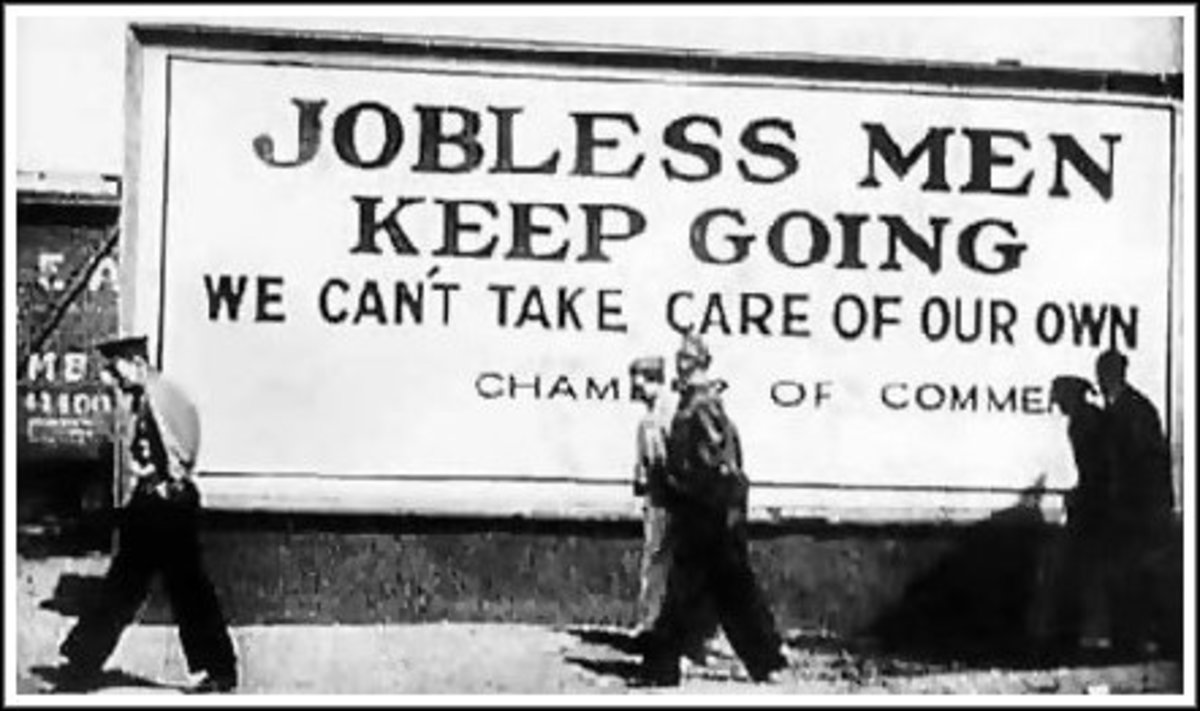

In the 1920’s – known as the Roaring Twenties – it seemed that everything was set fair for the future. World War I was a memory, and there was widespread industrialization and increasing production, which fuelled a booming economy. The Stock Market was a sure thing, with the Dow Jones Industrial Average rising from 60 to nearly 400 from 1921 to 1929. New technologies, such as the radio, the car, and air flight, were in their infancy, and the only way was up!The Stock Market was so good, that people were not only investing their own money, but they were mortgaging their homes and putting the borrowed money, along with their life savings, in every hot stock they could. Some were buying stocks “on margin”, which meant they could control more for their dollar, and increase their gains. Even banks got in on the action, investing their depositors’ money on the market to generate higher revenues.Then came the period of the stock market crash, where the dramatic decline in share prices was led by a loss in value of one particular segment, the public utilities sector, where the fundamental values were reassessed in October 1929. Of course, there were some signs earlier, but the key dates for those involved were October 24th, 1929, called “Black Thursday” and the following “Black Tuesday”, 29th October, 1929, which together accounted for a 23% decline in share value. The high for the Dow was at the beginning of September, and by November it had plummeted 40%, down to 228.The US Federal Reserve had taken steps previously to cool what it saw as an overheating economy, raising the interest rates several times. Nonetheless, and probably not as result of this action, there had been signs of a bear market beginning before the stock market crash. The crash seems to have just been caused by panic and mass hysteria as investors as a group realized that the stock market boom was an overinflated bubble. This reaction was a prime example of mass psychology in action.Not that all signs had been ignored, however. In the Financial Times of October 7, 1929, the President of the American Bankers Association spoke of concern at the level of credit, and was quoted as saying “Bankers are gravely alarmed over the mounting volume of credit being employed in carrying security loans, both by brokers and by individuals.” Some smart investors, such as Jesse Livermore, who made money shorting the stock market, and Joseph Kennedy (John F. Kennedy’s father), who sold out before the crash, anticipated the impending adjustment, and were some of the few to survive and thrive.It seems that the reason that panic ensued was the heavily leveraged nature of many investors, who could not sustain holding a position that lost even a small amount without being personally in debt. There was no regulation of the amount that could be taken on margin, and this was decided by the individual broker, but could be as high as nine times the investment, i.e. the equity owned in the stock would be only 10%. You can understand that the investor in this position would feel vulnerable, and immediately try to sell out if he saw the market dropping. Of course, with so many shares for sale, the price plummeted. A record 13 million shares were traded on Black Thursday, and this record was beaten on the following Black Tuesday, with more than 16 million shares traded. The trading mechanisms broke down, the ticker tape machines couldn’t keep up, and the whole situation was a catastrophe.Once the selling rush started, the margin loans were called, which may have further exacerbated the situation. Many banks were caught with their deposits in the market, so even people not invested were losers of their fortunes. In the crash, 20,000 companies and 1616 banks went bankrupt. $3 billion was wiped off the market by the end of the first week –this was ten times more than the annual Federal budget. In personal terms, in the next year 23,000 Americans committed suicide, the highest number ever.Although the Stock Market Crash of 1929 is blamed for the losses in value, the Dow did not reach a bottom until July 1932, when it was down to 11% of the peak. The Great Depression which followed the Stock Market Crash lasted for at least ten years, and really wiped out many more people.Nowadays, the situation is more controlled, and regulations are in place to try to avoid a repetition. This includes closing the market if share prices lose too much value, and a more controlled system of margin trading. For a greater understanding of the workings of the stock market, and to protect yourself from ignorance, you are invited to take the free course at www.insightsupport.com .